Rob courtesy of Unsplash.

Why Money Supply Growth Is the True Cause of Inflation: Surprising How Important This Nobel Prize Winning Economist’s Theories Are Today

Milton Friedman, a prominent economist, and Nobel laureate believed that inflation is primarily caused by an increase in the money supply in an economy. According to his theory of monetarism, inflation is always and everywhere a monetary phenomenon.

Friedman argued that if the supply of money in an economy grows at a faster rate than the output of goods and services, then the excess money will lead to an increase in prices. This is because there will be more money chasing the same amount of goods, resulting in higher demand and therefore higher prices.

Friedman believed that the role of central banks in controlling inflation was to ensure that the money supply grew at a steady rate that was consistent with the growth of the economy. He advocated for a fixed rate of increase in the money supply, which would allow individuals and businesses to make long-term economic decisions with confidence.

Overall, Friedman's view on the causes of inflation emphasizes the importance of controlling the money supply to maintain price stability.

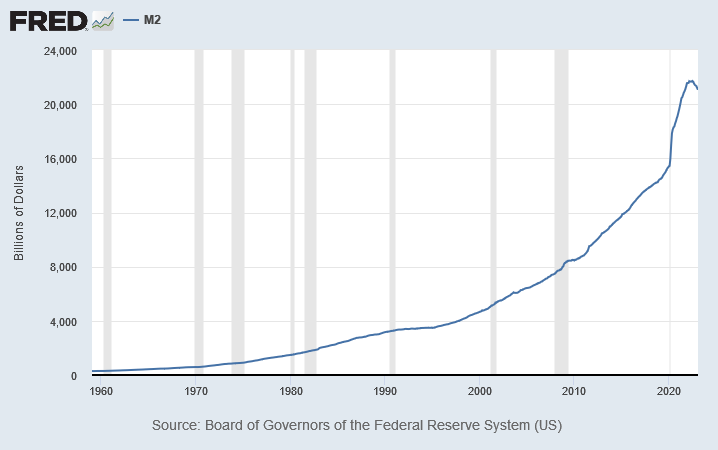

To measure the money supply growth, Friedman developed a measure known as M2, which includes the sum of currency in circulation, checking accounts, savings accounts, and small-time deposits. M2 represents a broader definition of the money supply than M1, which only includes currency in circulation and checking accounts.

Friedman believed that by controlling the growth rate of M2, the central bank could influence the rate of inflation. If the money supply grew at a steady rate that was consistent with the growth of the economy, then inflation would be low and stable. However, if the money supply grew too rapidly, then inflation would rise, leading to economic instability and uncertainty.

According to the Federal Reserve Bank of St. Louis, the M2 money supply in the United States has grown significantly over the past few decades. For example, in 1980, the M2 money supply was approximately $1.4 trillion, while as of March 2023 it had grown to approximately $21.7 trillion. That is an extremely large and unprecedented growth in money supply.

At iSectors® we believe that this unprecedented growth in money supply is causing and will continue to cause unprecedented price inflation over many years to come. Basically, the purchasing power of people’s savings will slowly be drained over time. Therefore, most investors would be wise to allocate at least a portion of their savings to investments that will maintain their purchasing power despite the growth in money supply.

Click here to review our iSectors® Inflation Protection Allocation model. A well-diversified portfolio of inflation hedges that may include precious metals, including gold and silver, real estate, commodities, including timber, agricultural and energy, strategic/rare earth minerals, and short-term inflation-protected bonds. For additional information about iSectors please visit iSectors.com or call 1-800-iSectors.