Time to Diversify into Gold?

Inflation is like a mischievous ghost that sneaks up on you and steals your money, leaving you with less purchasing power. You know something is up when you realize that the cost of a dozen eggs is now more than your first car. Maybe we are not quite there yet, but you get the point.

So, how do we protect ourselves from the greedy ghost of inflation? Enter: gold.

Gold is like the superhero of investments - it's been saving people from financial doom for thousands of years. When inflation rears its ugly head, people flock to gold because it's seen as a safe haven.

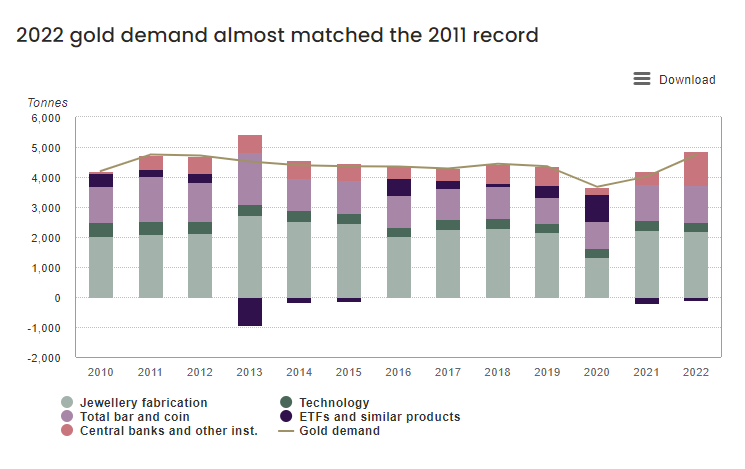

According to the World Gold Council (WGC), 2022 was the strongest year for gold demand in over a decade.

But don't let gold beguile you; investing in gold is not without its risks. The price of gold can be more volatile than a rollercoaster.

So, while investing in gold, or other precious metals, can be a helpful strategy, it's important to remember that it's just one piece of a well-diversified investment portfolio. No matter how enamored you may be with precious metals, don't put all your eggs in one basket.

Advisors looking to protect their clients against the risk of rising inflation and the devaluation of the dollar may want to consider allocating a portion of their client portfolios to one of iSectors’ alternate investment allocation models.

iSectors® Inflation Protection Allocation or iSectors® Precious Metals Allocation are a way to gain exposure to precious metals without directly acquiring and holding physical precious metal bullion.