The Past, Present, and Future of Bitcoin Futures ETFs

The potential SEC approval of spot Bitcoin ETFs has the crypto markets in a frenzy. The price of Bitcoin reflects this – up 33% over the last month (Yahoo Finance). As rumors have swirled regarding the timing of spot ETF approval, not only has the price of Bitcoin surged, but inflows into other Bitcoin-related ETFs have also surged. Investors are clearly trying to capitalize on the possibility of Bitcoin’s price continuing to rise before and immediately after a spot ETF finally launches in the United States. The most notable of these ETFs that have seen inflows is the ProShares Bitcoin Strategy ETF (BITO). This ETF tracks the price of Bitcoin by investing in Bitcoin futures contracts listed on the CME Futures Exchange. Over the past month, BITO has seen inflows of nearly $200 million; this is the most significant monthly inflow since the ETF’s inception in late 2021 (data from ETF.com).

One question to ask about BITO specifically is whether the recent inflows are warranted. If an investor thinks the price of Bitcoin will keep rising before a spot ETF is approved, is investing in BITO an adequate way to accomplish this goal? Currently, in terms of accessing Bitcoin via a tradeable security, BITO does provide a reasonable replacement return stream compared to the actual price of Bitcoin. Of course, investing directly in Bitcoin via a crypto exchange like Coinbase would be a purer way to invest, but when it comes to investments with ticker symbols that an advisor could trade in a client portfolio, BITO is a suitable proxy.

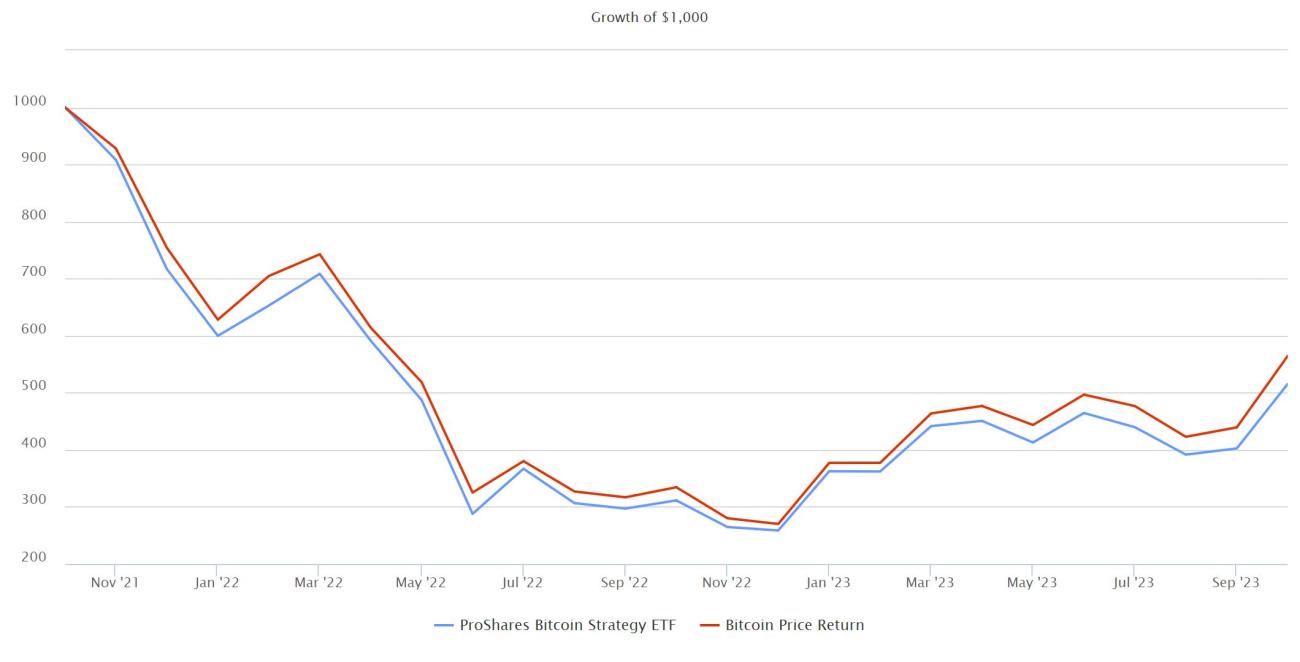

Some items contribute to a slight tracking error in BITO’s returns versus the price return of Bitcoin, such as the management fee and the roll methodology of the underlying futures contracts. However, even with these drags on performance, the correlation of BITO to the price of Bitcoin has been 0.99 since the inception of BITO in November 2021. This relationship is illustrated in the chart below, showing the returns of BITO vs. Bitcoin since BITO’s inception (data from Morningstar and eVestment).

While BITO currently provides a great way to access the return stream of Bitcoin, going forward, the outlook may not be so bright. While this type of strategy can track the price of Bitcoin well, an ETF that actually holds the underlying Bitcoin that the shares represent will likely match the price of Bitcoin even more closely, possibly for a lower price.

A similar story unfolded many years ago in the gold ETF market. Before the 2004 launch of the SPDR Gold Trust (GLD), the first gold ETF that owned the underlying gold bullion represented by the ETF shares, there were gold futures ETFs trading contracts to track the price return of gold. However, as the years went by, and it became apparent that GLD and its eventual competitors could handle large trading volumes and accumulate the necessary gold to back investors’ shares, the gold futures products fizzled out and are no longer on the market today.

The same could eventually happen to BITO, although we are a long way from that happening. Right now, almost everything in the crypto market hinges on the spot Bitcoin ETFs getting SEC approval. Even with all the rumors swirling, it is increasingly likely that we will have to wait until at least 2024 for that to happen.

If you are an advisor considering allocating a portion of your client assets to cryptocurrency, you may be interested in the iSectors® CryptoBlock® Allocation. It is an ETF model portfolio consisting of Bitcoin exposure via BITO while also containing a mixture of blockchain equity ETFs that complement and offset the volatility of Bitcoin. Contact us today to see if you have access to any of the TAMP platforms where the iSectors® CryptoBlock® Allocation is currently available.