Sabrianna courtesy of Unsplash.

Do You Own Gold?

Gold is often considered a better option for preserving purchasing power than cash because it has certain qualities that make it a more reliable store of value over the long term. Here are some reasons why:

- Limited Supply: Gold is a finite resource, and the amount of new gold that can be mined each year is relatively small. This means that the total supply of gold is limited, which helps to prevent inflation from eroding its value over time.

- Tangible Asset: Unlike cash, which is a purely digital or paper-based asset, gold is a physical commodity that can be held in your hand. This gives it an inherent value that is not dependent on the stability of any financial system or government.

- Universal Acceptance: Gold has been used as a form of currency and a store of value for thousands of years, and it is accepted all over the world. This means that if you need to convert your gold into cash, you can do so easily and without any loss of value.

- Diversification: Holding gold in addition to cash can help to diversify your portfolio and reduce overall risk. This is because the value of gold tends to move independently of other assets, such as stocks and bonds, which can help to offset losses in other areas of your portfolio.

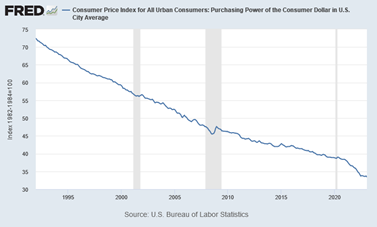

- Inflation Hedge: Gold has historically performed well during times of high inflation, which can erode the purchasing power of cash. Because gold is a tangible asset with limited supply, it tends to hold its value better than cash during periods of inflation.

Of course, it's important to note that gold also comes with its own risks and drawbacks, such as the possibility of theft, storage costs, and fluctuations in value. As with any investment, it's important to do your research and consider your own financial goals and risk tolerance before deciding whether to invest in gold or any other asset.

iSectors® Inflation Protection Allocation or iSectors® Precious Metals Allocation are a way to gain exposure to precious metals without directly acquiring and holding physical precious metals bullion.