Alternative Asset Classes - Where Mutual Funds Could Make More Sense Than ETFs

Even with all the advantages ETFs offer compared to mutual funds, there are still some areas where ETFs might not be able to provide ideal exposure. The prime example of this is in the alternative asset class. This would include strategies such as market neutral, long/short equity, event driven, and managed futures.

Over the past 5 years or so, many ETF versions of these strategies have launched and then closed within the next few years. If you do a search for any ETFs in this asset class, you may find a list of appealing ideas and seemingly competitive products launched in the last few years.

The lower fees and transparency of these ETFs compare favorably to their mutual fund brethren. However, an extra level of diligence should be applied to these products. At iSectors we’ve notice some potential problems such as:

- An ETF may fail if it consistently underperforms its benchmark index or other similar ETFs in the same category. Investors may choose to withdraw their money and invest in other funds, which can cause the ETF to lose assets and eventually close.

- ETFs trade on stock exchanges, which require a certain level of liquidity to maintain a healthy market. If an ETF has low trading volumes, it can become difficult to buy or sell shares at a fair price, which can lead to investors avoiding the fund and eventually causing it to fail.

- Market conditions can change rapidly, which can affect the performance of an ETF. For example, if a particular sector or industry falls out of favor with investors, an ETF that tracks that sector may also suffer and lose assets.

- ETFs are complex financial instruments that require careful management and oversight. If an ETF's management team makes poor investment decisions, experiences operational issues, or fails to adhere to regulations, it can lead to the failure of the fund.

- Some ETFs use derivatives or other financial instruments to achieve their investment objectives. If the counterparties on these instruments fail to fulfill their obligations, it can cause the ETF to suffer losses and potentially fail.

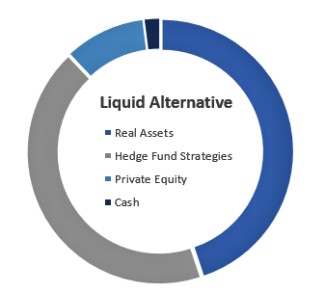

iSectors® conducts this extra diligence on the holdings in our models so that you don’t have to. The iSectors® Liquid Alternatives Allocation contains a blend of alternative mutual funds and ETFs within the categories mentioned above, but also includes additional allocations to real assets and quasi-private equity holdings. For more information about this model, please don’t hesitate to contact us.