Jingming Pan courtesy of Unsplash.

Stagflation! Is Now the time to buy Precious Metals?

Gold has historically performed well during stagflation, a period of high inflation and high unemployment. In the 1970s, as the US experienced stagflation, the price of gold surged from $100 per ounce in 1976 to around $650 per ounce in 1980, as inflation reached 14%. It is believed that during stagflation, investors tend to turn to gold as a safe haven asset as the economic and financial conditions are uncertain. Additionally, gold is seen as a hedge against inflation, as its value is not tied to any currency or government.

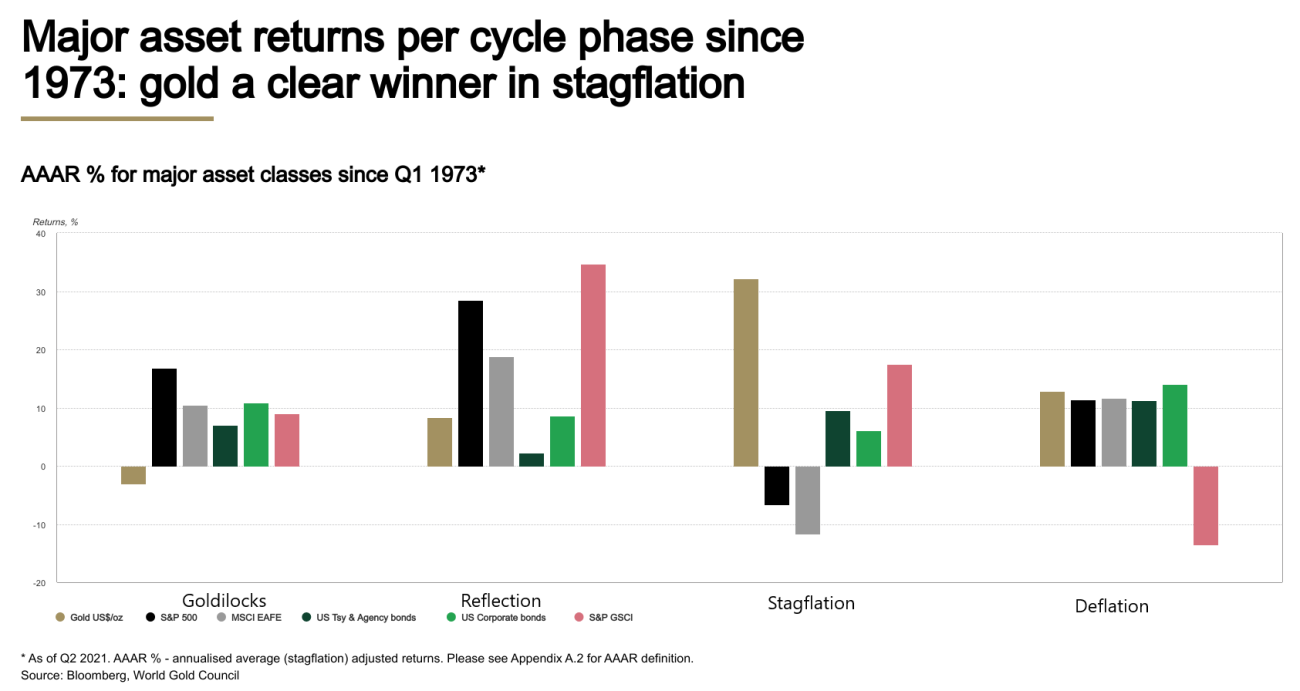

In fact, gold outperforms other asset classes during times of economic stagnation and higher prices. The chart below shows that, of the four business cycle phases since 1973, stagflation is the most supportive of gold, and the worst for stocks, whose investors get squeezed by rising costs and falling revenues. Gold returned 32.2% during stagflation compared to 9.6% for US Treasury bonds and negative 11.6% return for equities.

According to the World Gold Council, a look at US economic history back to 1971 reveals that stagflation has been the most frequent scenario (occurring in 68 of the 201 quarters) as well as the most enduring, having twice lasted eight consecutive quarters.

In summary

iSectors’ believe we are in a stagflationary economic environment and gold does well in stagflationary environments. The current economic environment characterized by high levels of debt, looming deficits, and supply-driven inflation presents a unique challenge for central banks. Raising interest rates may not be effective in bringing inflation under control and could further exacerbate debt problems and increase the risk of a recession. In this stagflationary scenario, gold can be an attractive investment as it is often seen as a hedge against inflation and a safe haven during times of economic uncertainty. Additionally, a shift from monetary tightening to easing due to poor economic performance or a recession could lead to a weaker dollar, which would also benefit gold and other precious metals.