Giorgio Trovato courtesy of Unsplash.

Money Supply: Why it Matters!

The relationship between money supply growth and inflation is a widely debated topic in economics. The general belief is that an increase in the money supply can lead to higher inflation if the supply of goods and services does not increase at the same pace.

When the money supply grows, it means that there is more money in circulation, which in turn can increase the demand for goods and services. This increase in demand can drive up prices, which is measured as inflation.

For example, let's say the central bank increases the money supply by printing more money. This increase in the money supply can cause people to have more money to spend, which in turn can drive up demand for goods and services. If the supply of goods and services does not increase at the same pace, then prices will rise, leading to inflation.

However, it's important to note that the relationship between money supply growth and inflation is not always straightforward. The delay between the money supply growth and its impact on inflation can vary depending on the state of the economy and other factors.

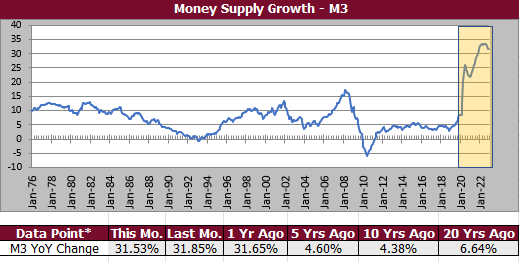

iSectors® monitors a broad measure (M3) of changes in money supply each month. The longer-term growth in money supply is one of the economic factors that lead us to believe inflation will likely remain stubbornly high despite higher interest rates.

Please contact us if you have any questions on iSectors® Allocation models that may help investors preserve the purchasing power of their savings despite stubbornly high levels of inflation.