The Correlation Convergence

Correlation convergence refers to a phenomenon in which the correlation between two or more assets increases especially during periods of market stress or volatility. This means that the prices of these assets tend to move in the same direction, either up or down, as investors flee to safety or take on more risk.

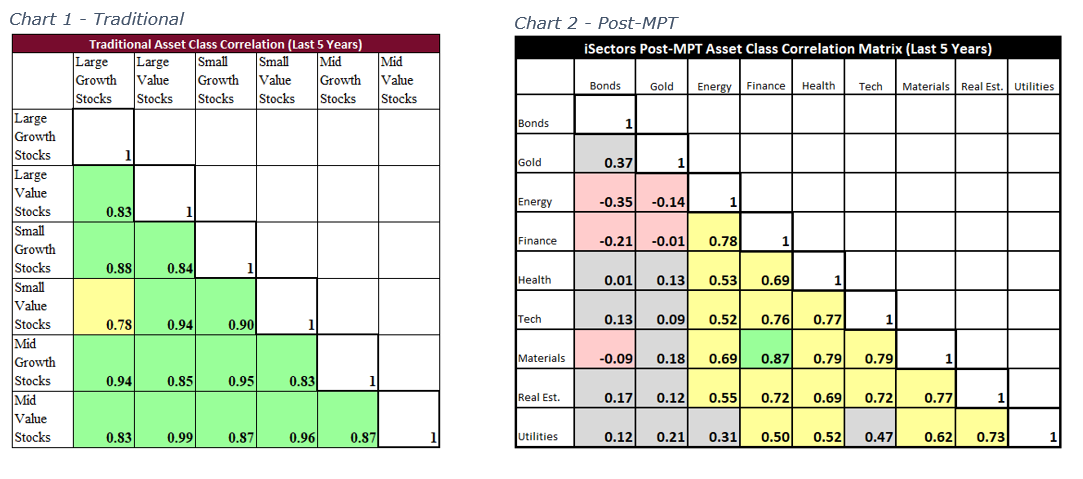

When calculating correlation (how two investments move relative to each other) the solution is always between 1 and -1. A correlation of 1 means the two investments are perfectly positively correlated. Therefore, if one of the investments goes up or down, the other investment will go up or down exactly the same. If two investments have a correlation of -1 that means the two investments are perfectly negatively correlated. Therefore, the two investments move exactly opposite to each other. That is, if one investment goes up 1% you would expect the other investment will go down 1%. Two investments with a 0 correlation would theoretically have no correlation to each other. Ideally, to reduce risk through diversification, the investments you own should have a low or even negative correlation to each other. Holding a diversified portfolio of investments with high correlations (1 or close to 1) does not reduce risk.

The correlation of many asset classes has been converging (on 1), even when markets are calm and stable (see chart 1). But during times of crisis (down markets), correlations tend to converge (all go down together), and assets that were previously considered diversified may suddenly all go down at the same time.

For investors, this means that diversification may not provide the risk protection they expect during market downturns, as the assets in their portfolio may become more highly correlated than anticipated. Therefore, it is important to understand the correlation patterns of different assets and consider the potential impact of correlation convergence when making investment decisions.

Contact us to discuss correlation convergence and learn how we can help. iSectors® Post-MPT Allocation models diversify among 9 asset classes with low correlation (see chart 2).