Basic Information About Basic Materials

In recent months, the iSectors® Post-MPT Growth Allocation has had the highest allocation to the basic materials sector it has had in over 10 years. It is an often overlooked and underweighted sector. It currently has a meager 2.4% allocation in the S&P 500. However, basic materials companies are more important than one may think. Here is a quick definition of the sector, courtesy of Investopedia:

“The basic materials sector is an industry category made up of businesses engaged in the discovery, development, and processing of raw materials. The sector includes companies engaged in mining and metal refining, chemical products, and forestry products.”

Many of the raw materials developed by these types of companies are utilized in some form or fashion by almost every other industry. The widespread usage of these raw materials, however, does not shield the sector from being susceptible to the ebbs and flows of the business cycle. As the economy expands and contracts, basic materials tend to move in the same cyclical pattern. Some examples of companies that would be included in a basic materials index are very well-known names like Dupont ($DD) and Sherwin Williams ($SHW).

Speaking of stocks within the basic materials index, many of these companies pay consistent dividends. To learn more about the benefits of dividend paying stocks see our blog Dividend Investment Strategies.

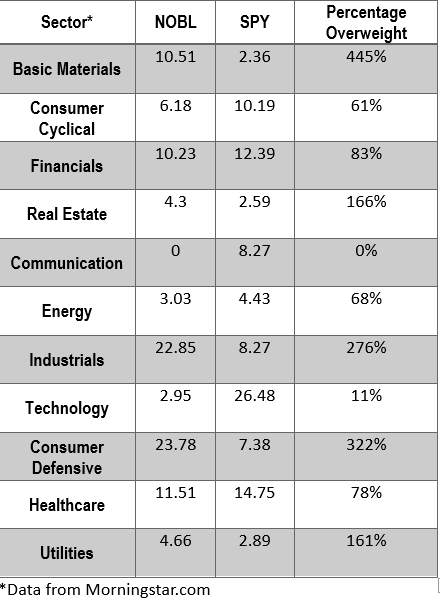

In the S&P 500 Dividend Aristocrats Index, which only contains stocks that have raised their dividends each year for 25 or more consecutive years, basic materials represent the largest sector overweight when comparing the S&P 500 itself to the S&P 500 Dividend Aristocrats Index. You can see this illustrated below in the sector exposures of the ProShares S&P 500 Dividend Aristocrats ETF ($NOBL) and the SPDR S&P 500 ETF (SPY). The way to read the chart is that basic materials has a 4.5x higher allocation in NOBL compared to SPY.

If you have any questions about basic materials, or any of the other asset classes utilized by the iSectors® Post-MPT Allocations, please do not hesitate to contact us.